- #XERO ACCOUNTING SOFTWARE REVIEWS UK TRIAL#

- #XERO ACCOUNTING SOFTWARE REVIEWS UK PROFESSIONAL#

Forecast Financial Estimates: Accounting information is necessary for obtaining outside financing for the new business venture.Small business accounting software powered with analytics or specific accounting systems for certain industries such as retail accounting software can help businesses gain expert actionable insight into their operations.

#XERO ACCOUNTING SOFTWARE REVIEWS UK PROFESSIONAL#

Entrepreneurs also need professional help while filing business tax returns and also to ensure that all the business issues are being accounted for at year end.

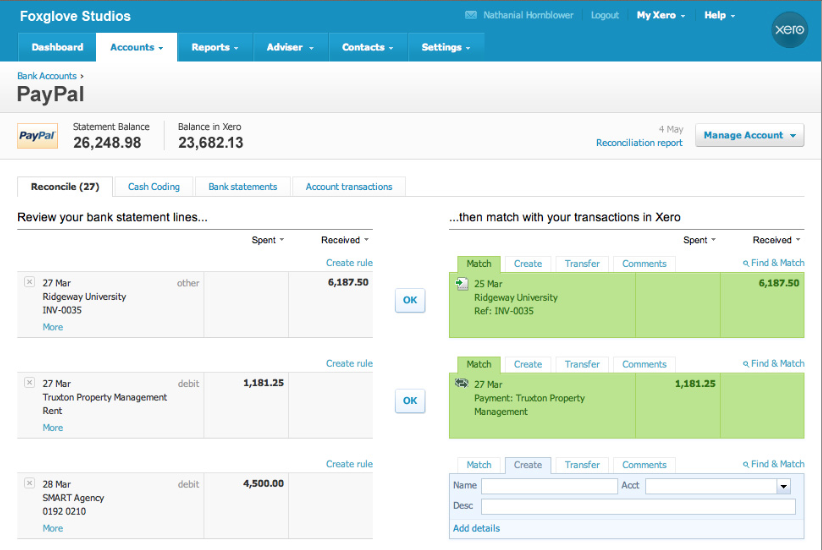

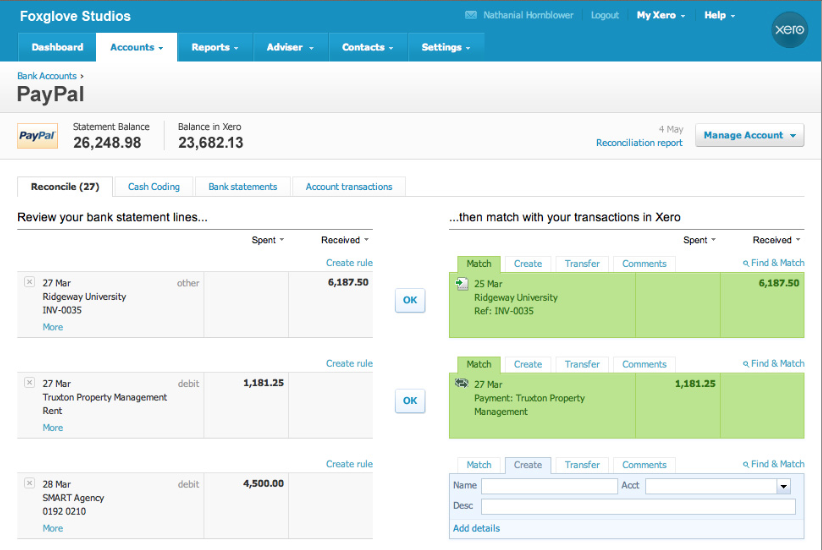

Expert Insight: Businesses may seek advice from an individual public accountant or from public accounting. Also, small businesses need to release the financial information to ensure the banks and lenders that they will be repaid within the time limit. Entrepreneurs also need to understand the fair usage of assets to generate services and the costs of inventory in comparison to the company profit margin. Determining Profitability : Determination of profitability is easily possible with the help of accounting. Budgets also help in creating a historical record of how the business is spending its capital for producing consumer goods and services. A budget helps in outlining the expenditures which are needed for various aspects of the business. Budget Expense: Budget Creation is an important online accounting software function necessary for starting a business. Good financial accounting system can make the implementation of accounting practices much easier. Accounting practices consist of mainly three types of record keeping like journals, subsidiary ledgers and the general ledger which is used in small businesses. The information is not only valuable for the business owner but is also required by the appropriate tax authority. Every business needs account management software to calculate the profit or loss that it makes over time. The Accounting system in small business provides a clear and true picture of the business success with all the financial software documents. Entrepreneurs are often required to understand and complete a variety of business functions while starting a business. The accounting system is one of the essential business/ Personal finance software, which is required while starting a small business. Importance of Accounting Practise While Starting a Business: This function helps in saving time on tasks like bank reconciliation. Most of the cloud-based accounting software automatically enter, store and analyze the data. Different tasks can be operated by different kinds of best accounting tools. It greatly varies in its cost and complexity.  It can be used on both desktop as well as online and can be accessed anywhere via any device at any time which has an internet connection. Types of Accounting System:Īccounting tools can range from sophisticated, double-entry systems which process inventory, payroll, accounts receivable and accounts payable to simple, single-entry programs used for individual record-keeping. It is completely apt for small business accounts as well as large businesses. Online Accounting software is mainly created for the purpose of internal and external audits, financial software analysis and required reports to meet internal and legal managerial requirements. Professional Accounting also includes interpretation, summation, verification, classification, diverse and systematic measurement of financial data. It' s a systematic practice of recording or communicating financial information. Business accounting system performs a systematic practice of recording or communicating financial information. The best accounting software is mainly used by accounting professionals or small business accountants to perform accounting operations.

It can be used on both desktop as well as online and can be accessed anywhere via any device at any time which has an internet connection. Types of Accounting System:Īccounting tools can range from sophisticated, double-entry systems which process inventory, payroll, accounts receivable and accounts payable to simple, single-entry programs used for individual record-keeping. It is completely apt for small business accounts as well as large businesses. Online Accounting software is mainly created for the purpose of internal and external audits, financial software analysis and required reports to meet internal and legal managerial requirements. Professional Accounting also includes interpretation, summation, verification, classification, diverse and systematic measurement of financial data. It' s a systematic practice of recording or communicating financial information. Business accounting system performs a systematic practice of recording or communicating financial information. The best accounting software is mainly used by accounting professionals or small business accountants to perform accounting operations. #XERO ACCOUNTING SOFTWARE REVIEWS UK TRIAL#

Accounting software is a small business financial management software that records and processes the accounting transactions within the functional modules such as trial balance, payroll, general ledger, accounts receivable, accounts payable.

0 kommentar(er)

0 kommentar(er)